Payers & Insurers

Smarter Risk Management Starts with Better Data

Lavaa equips health plans and insurers with the tools to proactively manage population risk, reduce long-term costs, and support preventive care with real-time, actionable insights.

Prevention-Focused Intelligence

Millions of Americans change insurance plans each year. Lavaa helps you act quickly by surfacing near-term risk for chronic and high-cost conditions like diabetes, kidney disease, and hypertension—so you can intervene sooner and spend smarter.

Designed for Precision

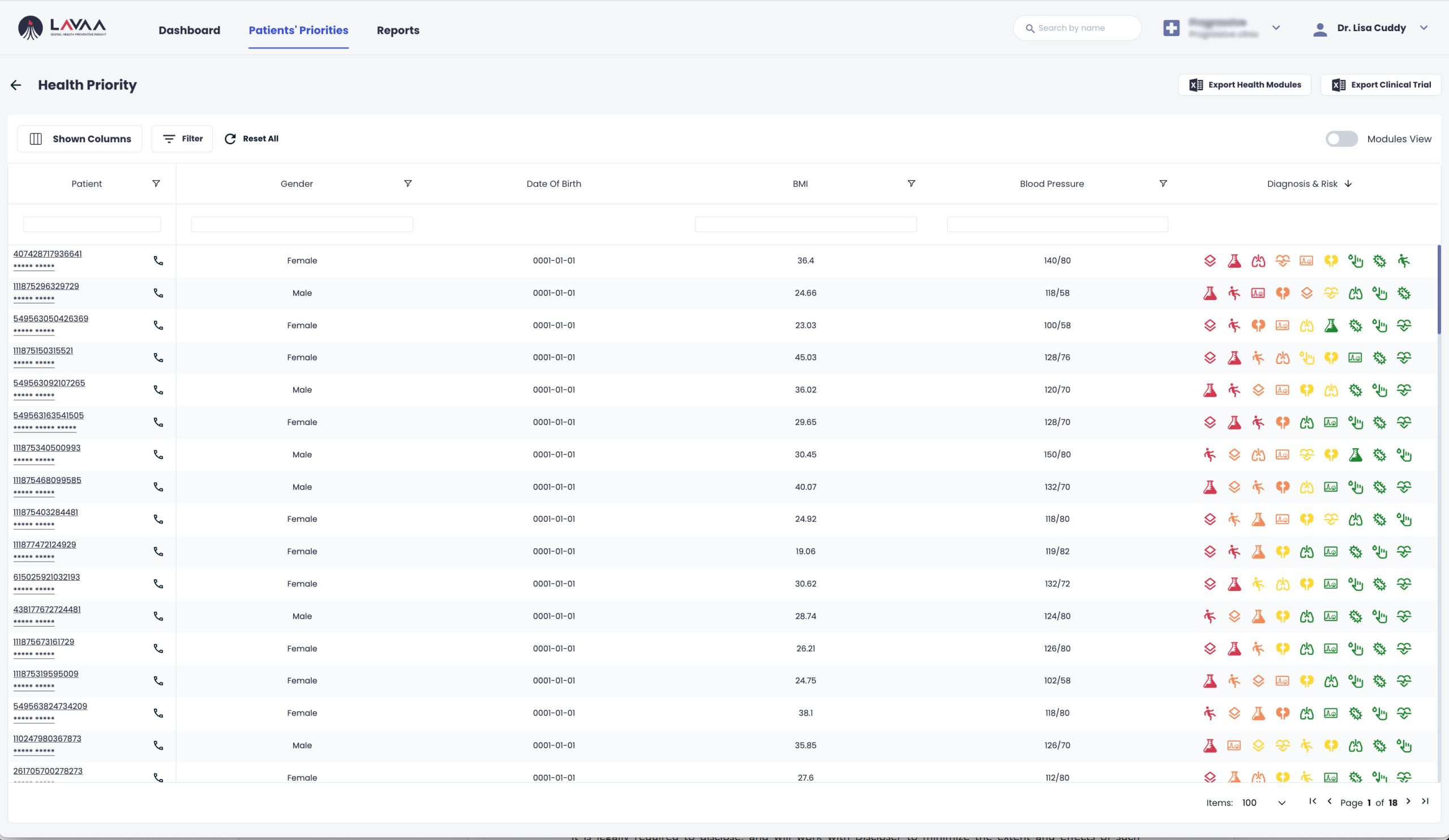

Lavaa’s HIPAA-compliant platform analyzes granular health data to support:

- Accurate risk scoring

- Streamlined claims processing

- Strategic premium and co-pay adjustments

- Targeted prevention incentives

Whether you use our pre-built engines or create your own in the Interactive Development Environment, Lavaa helps you make sense of once-diffuse datasets to drive better outcomes—for both your members and your business.

What Lavaa Helps You Do

With Lavaa, payers and insurers gain:

- Remote patient monitoring options

- Early detection of chronic, cancer-related, and behavioral health risks

- Prevention programs based on certified clinical protocols

- Patient-specific risk scores for smarter underwriting

FAQs for Payers & Insurers

Frequently Ask Questions

Learn how Lavaa helps insurers optimize care delivery, manage risk, and reduce unnecessary costs.

Lavaa generates dynamic risk scores using real-time clinical data, allowing payers to assess short-term and long-term patient risks with far greater accuracy.

Yes. By incorporating granular health data and AI-powered insights, Lavaa helps refine premium calculations, co-payment settings, and plan design.

Absolutely. Lavaa is HIPAA, SOC 2, and ISO 27001/27701 compliant. We do not store PHI and ensure secure, encrypted access at every level.

Yes. Using Lavaa’s Interactive Development Environment, payers can build custom engines to align with specific business models and data strategies.

Lavaa’s personalized pathways, alerts, and prevention prompts can be integrated into member engagement workflows to drive higher adherence and better outcomes.